will the salt tax be repealed

After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say theyll vote for the. The United States Supreme Court rejected New Jersey and other states requests to restore the full income tax deduction for state and local taxes.

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

We examine how the repeal of the state and local taxes SALT cap in 2021 would affect federal revenue and the tax liabilities of taxpayers in each of the 50 states.

. At the time they were weighing in on. Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be.

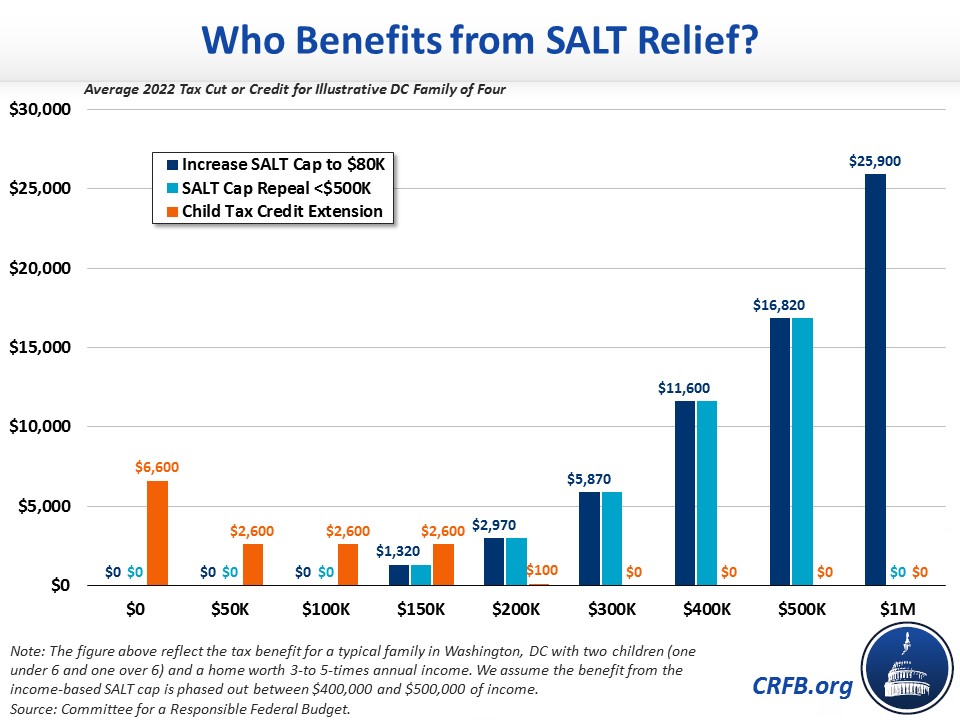

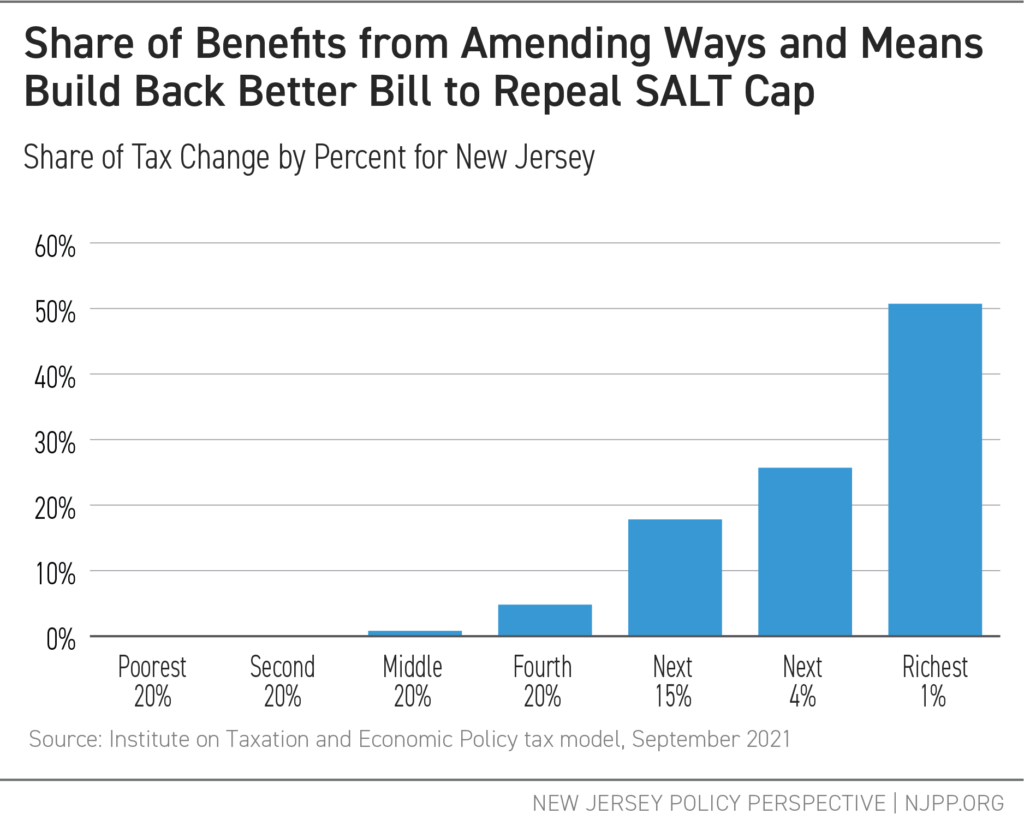

When SALT is repealed the taxes will be going down What he really means is if the cap is lifted overall state and federal taxes will be less for some taxpayers than if its not. The Tax Policy Center found that only 3 of middle-income households would pay less in taxes if the SALT cap is nixed. The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000.

Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging. And Mikie Sherrill D-N-J in a joint statement in January.

No SALT no deal said Reps. The Tax Foundation predicts that a full repeal of the. Josh Gottheimer D-NJ Tom Suozzi D-NY.

A bill from House Ways and Means Chairman Richard Neal and others would modify and then repeal for two years the 2017 tax laws cap on the federal deduction for state.

Salt Cap Repeal Below 500k Still Costly And Regressive Committee For A Responsible Federal Budget

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Deduction Would Expand Under Build Back Better Bill But Its Fate Is Uncertain

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

House Democrats Concede Line In Sand Over Ending Salt Cap Politico

Salt Cap Repeal Would Overwhelmingly Benefit High Income Households Tax Policy Center

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Cap Repeal Disproportionately Favors Wealthy People R Neoliberal

Salt Deduction Cap Repeal Gottheimer And Suozzi Discuss Tax Cuts

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Porter Backed Bill Seeks To Restore Salt Deductions Capped Under 2017 Tax Act Orange County Register

Will Biden Repeal Gop S Tax Change That Reduced His Deductions By 352 000 The Motley Fool

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Will Congress End Cap On State And Local Tax Deduction Deadline Looms

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union